Chancellor Osborne’s budget on Wednesday confirmed that the ruthless Tory-LibDem assault on the poor, the low paid, the unemployed, the sick and the disabled not only continues but will escalate. There will be no reversal of the austerity drive against public services, welfare benefits and the employment terms and conditions of public sector workers.

l

Why so?

l

Because, as last weekend’s People’s Assembly conference recognised, austerity is indeed working – for the rich and big business. It was never intended primarily to reduce the state’s financial deficit. If it were, City of London bankers and other speculators would be punishing Osborne for his spectacular failure.

l

In his contrived ’emergency’ budget of June 2010, the Chancellor had boasted that annual government borrowing would be reduced to £60bn (or 3.5 per cent of GDP) by this year. In reality, it is now £108bn (6.6 per cent of Britain’s economic output). The national debt would reach 70 per cent of GDP and begin to decline. It currently stands at 75 per cent and is rising not falling.

l

Osborne has little or no hope of eliminating the deficit in 2018 as planned (but orginally set for 2015), without even deeper cuts in public spending, probably combined with further hikes in regressive taxation such as VAT and excise duties.

l

Imposing an annual spending cap on welfare – currently set at £119bn in real terms – throughout the next parliament will be central to this intensified austerity drive. Astonishingly, the Labour ‘opposition’ want such a cap – albeit set at a higher level – to include the state retirement pension, so that it can be under the cosh as well!

l

How the cap will be used to clobber various unemployment, disability, maternity and other payments will doubtless be unveiled in another ’emergency’ budget after the 2015 general election. In the meantime, Osborne will pretend to be ‘upset’ that the news headlines concentrate more on his tax relief for bingo, beer and cider than on his strategic genius.

How the cap will be used to clobber various unemployment, disability, maternity and other payments will doubtless be unveiled in another ’emergency’ budget after the 2015 general election. In the meantime, Osborne will pretend to be ‘upset’ that the news headlines concentrate more on his tax relief for bingo, beer and cider than on his strategic genius.

l

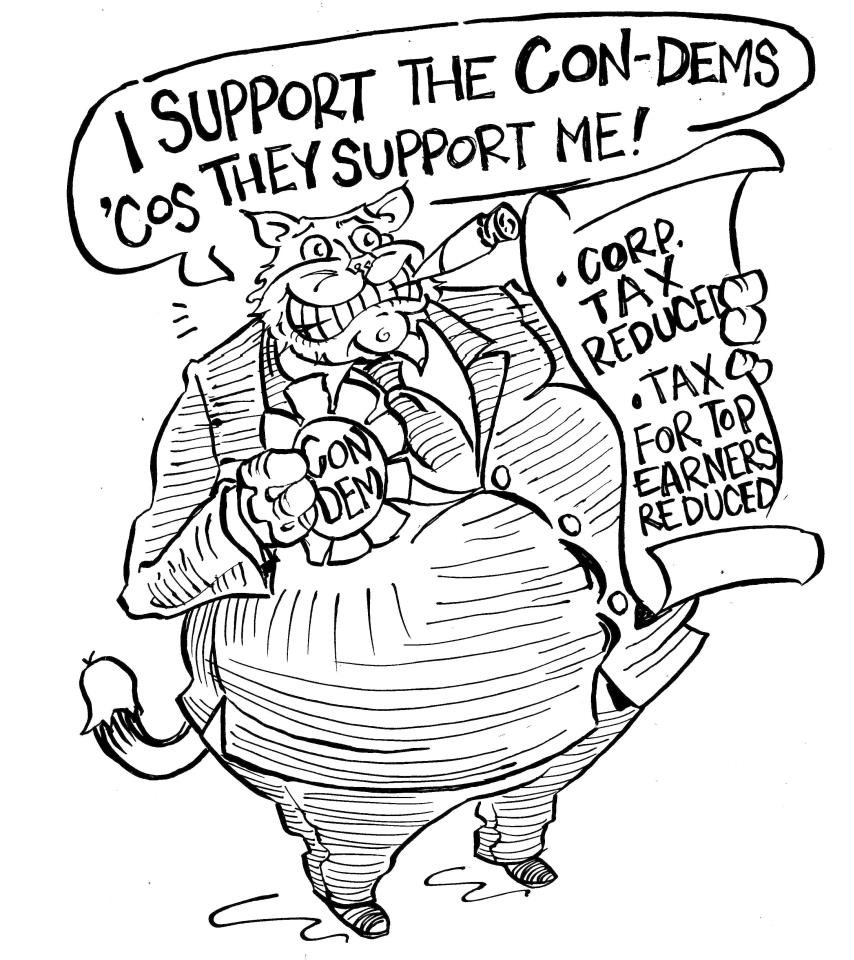

No, the City is pleased with this latest budget. All those donations to the Conservative Party represent money well spent.

l

The austerity strategy is delivering lower taxes on the rich and big business, more loot for the banks in the shape of ‘quantitative easing’, weaker bargaining power on the part of organised labour and the privatisation of public services including the Royal Mail, probation services and, in England at least, the NHS and secondary education.

l

Despite rampant crookery, fraud and incompetence in the City of London, the banksters are being shielded from the retribution they so richly deserve.

l

The overall result has been a substantial depression in real wages (by an unprecented 9 per cent since the coalition seized office) and – for most monopolies in most sectors of the economy – the maintenance or expansion of profits.

l

All the talk about banking reforms, tighter regulation and clampdowns on corporate tax avoidance and bonuses have been just so much hot air.

l

As usual, the main winners in this budget are big business and the super-rich. A fresh raft of tax relief measures will enable manufacturing and energy corporations and the property developers to boost their profits still further. Cuts in corporation tax and final abolition of the top rate of income tax will proceed as planned.

l

Just as the UN Intergovernmental Panel on Climate Change is about to publish its most alarming findings so far, the Chancellor proposes to scrap the ‘escalator’ increase in tax on companies with high carbon emissions.

l

While some of the world’s most eminent scientists warn that higher temperatures, more floods and wilder weather will chop crop yields, spread water and air borne diseases and displace millions more people, Osborne does Prime Minister Cameron’s bidding to ‘get rid of all the green crap’.

l

Interestingly, the Chancellor subsequently blamed the EU emissions trading system for placing British firms at a disadvantage, thereby requiring his tax relief. That the ETS is a racket, giving EU monopolies a licence to speculate while buying pollution rights from the Third World, was evident from its introduction in 2005.

l

Predictably, with next year’s general election looming ever larger, Wednesday’s budget contained some sweeteners for the electorate. These include a higher starting threshold for income tax – due to kick in on the eve of polling day (May 7) – and a package of state subsidies for childcare.

l

Reforms and tax concessions relating to personal savings will, by definition, benefit only those people who can afford to save up to £15,000 a year.

l

Crucially, many of these will be key electors in constituencies where the electoral struggle will be between the Tories, LibDems and UKIP.

Crucially, many of these will be key electors in constituencies where the electoral struggle will be between the Tories, LibDems and UKIP.

l

The Help to Buy scheme which subsidises buyers of new houses and guarantees repayments to their mortgage lenders is being extended for four years beyond 2016, even though the consequences might well be a housing price bubble followed by a slump and negative equity. The Treasury reckons the scheme will stimulate the construction of 120,000 new private sector houses over the whole period.

l

Yet Britain needs 250,000 new homes to be completed every single year. Most of those have to be affordable for people on low and middle incomes. So far, the government has pledged to ensure that just 150,000 of these are built throughout the whole current parliamentary term.

l

Public spending on new council and social housing has been cut since 2010 by at least half or almost £2bn a year even with the New Homes Bonus, while tenants face higher rents to make up some of the shortfall. Incredibly, the government is placing its faith and public money in property developers and the private rented sector, for example through the £1bn Build to Rent fund.

l

In response to the budget, some of Labour’s anti-toff rhetoric has been magnificent but it is not class war.

l

It needs to be translated into policies. At the moment, the Shadow Cabinet is committed to maintaining the public sector pay freeze, abiding by Tory-LibDem spending plans for one year after the general election and sticking to a welfare spending cap for the entire parliamentary term.

l

This will not set the voters on fire to ensure a Labour victory at the polls. But it underlines the need to build the People’s Assembly into a powerful mass movement against austerity and privatisation. In alliance with the trade unions, it will be needed as much after May 2015 as it is today.

l

In the meantime, there is vital work to do, persuading people across Britain that austerity is not necessary and that there is an alternative, embodied in the policies of the People’s Budget and the People’s Charter.

Sign the petition for a people’s budget!

People’s Budget:

On the eve of the budget, the People’s Assembly petitoned for a People’s Budget containing the following demands:

- Renationalise our services and remove private profit from health, education and social services.

- For a statutory living wage, abolish zero hour contracts, end the wage freeze.

- Invest in social housing, abolish the Bedroom Tax and cap private sector rents.

- Increase taxation on the rich and clamp down on tax avoidance.

- Reverse all spending cuts.

- Invest to create green jobs.

- Increase social benefits and pensions in line with inflation.

- Stop the scapegoating of immigrants and welfare claimants.

- For a publicly owned, democratic banking system.

- End the cost of war in blood and money, no military interventions, no Trident replacement.